The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized set of policies and procedures designed to optimize the security of credit, debit, and cash card transactions.

Established in 2004 by five major credit card companies — Visa, Mastercard, Discover, JCB, and American Express — PCI DSS is not a law but is typically part of contractual obligations for businesses that process and store payment card transactions.

The primary goal of PCI DSS is to protect the security of sensitive cardholder data, such as credit card numbers, expiration dates, and security codes. The standard’s security controls help businesses minimize the risk of data breaches, fraud, and identity theft.

Compliance with PCI DSS also ensures that businesses adhere to industry best practices when processing, storing, and transmitting credit card data, fostering trust among customers and stakeholders.

PCI DSS is built around six standards, each with specific requirements:

These goals translate into 12 specific requirements, ranging from installing and maintaining a firewall to protect cardholder data environments, to maintaining an information security policy.

The standards apply to all entities that store, process or transmit cardholder data, including requirements for software developers and app/device manufacturers used in those transactions.

PCI DSS compliance is divided into four merchant levels, based on the annual volume of credit or debit card transactions processed by a business. These levels range from Level 1, for organizations handling more than 6 million card transactions a year, to Level 4, for organizations handling fewer than 20,000 annual card transactions. Each level has its own validation requirements.

Compliance with PCI DSS provides many benefits, including enhanced customer trust, reduced risk of data breaches, fraud protection, and compliance with industry standards.

It’s also important to understand the challenges, which include complexity, cost, the ongoing effort required for monitoring and updating security measures, and the need to adapt to a constantly changing payment card industry and cybersecurity landscape.

Using the six standards as a guideline, here are the ways that Concentric AI can help your organization with PCI DSS compliance.

Build and maintain a secure network and systems: Concentric AI’s solution connects to unstructured data storage, structured databases, messaging and email applications — whether they’re cloud-based or on-premises. What does this mean for you? Concentric can discover, categorize, and monitor data wherever it’s stored, which elevates your security across various networks and systems.

Protect cardholder data: Concentric AI provides comprehensive PII data discovery and categorization. Our solution leverages sophisticated machine learning technologies to autonomously scan and categorize data, including sensitive cardholder data, wherever it is stored. This comprehensive process aligns clearly with the PCI DSS goal of protecting cardholder data.

Maintain a vulnerability management program: Concentric AI uses Risk Distance™ analysis to autonomously compare data to its peers and instantly detect inappropriate permissions, inaccurate entitlements, risky sharing, and unauthorized access. Our solution also remediates these issues to reduce the odds of data loss or governance violations. What this means for you is that if you know where your risks are, you are in a much better position to deploy vulnerability management.

Implement strong access control measures: Concentric AI can autonomously discover how card data is being used, who it is being shared with, and who accessed it. This can help tremendously when it comes to managing access control and potentially reducing the risk of unauthorized access.

Regularly monitor and test networks: With the clear visibility into your data’s risk, Concentric AI’s solution can help respond to data access audits and data subject access requests (DSAR). Concentric can also proactively detect and remediate risk from sharing and access violations to prevent data loss and ensure compliance with various privacy regulations.

Maintain an information security policy: Leveraging Concentric’s solution can boost information security policy efforts by providing insights into data usage patterns and risks and also enforcing data access and sharing policies.

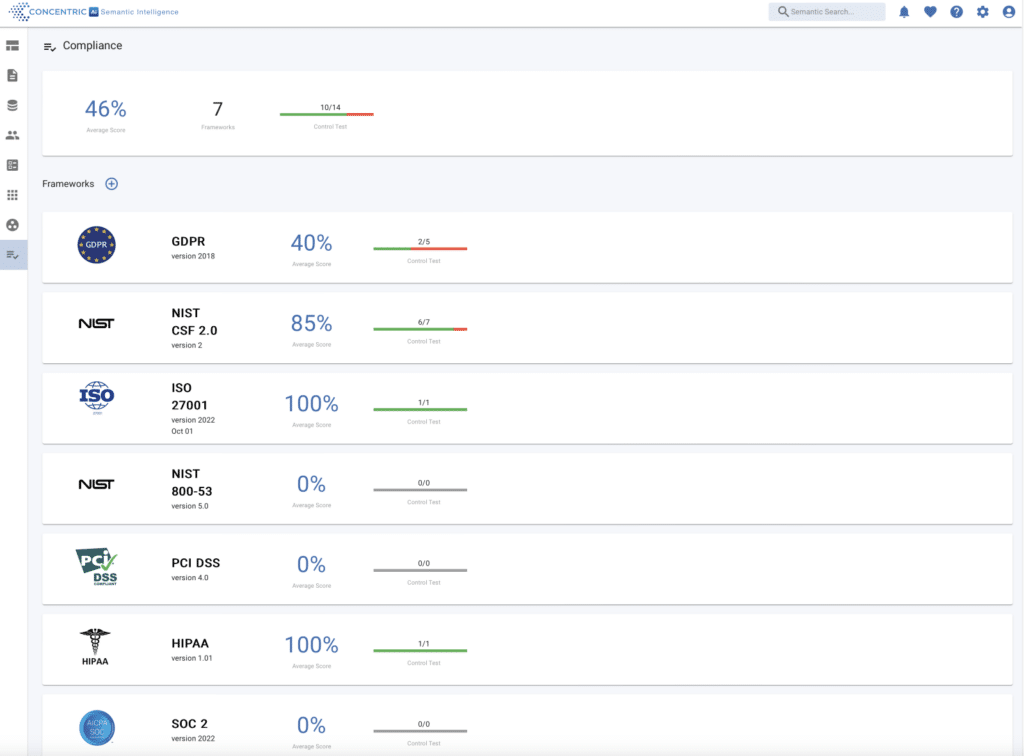

Concentric AI’s compliance dashboard offers a user-friendly interface that allows organizations to easily drill down into their compliance status.

By clicking on the Compliance icon on the bottom left of the main dashboard, organizations get an overview of all the key security frameworks.

To dive deeper into compliance for each framework, clicking on the framework brings up a list of framework rules that can be further broken down into controls.

The best part for your organization is that Concentric AI can reduce risk and protect your sensitive payment card data all without upfront policies, rules or regex. Plus, deploying the solution won’t require large teams to operationalize.

Want to see for yourself, with your own data, how Concentric can help you maintain PCI DSS compliance? Book a demo today.